Ray Dalio doesn’t spook easily. The man runs Bridgewater Associates, the biggest hedge fund on the planet. He’s been through his share of economic storms. But when he starts warning that the global financial system might be on the brink of collapse, it’s probably time to sit up and listen.

Appearing on Meet the Press this past Sunday, Dalio painted a picture that was anything but rosy. He didn't just toss around the “R” word—recession—like many economists have lately. He went several steps further, suggesting that we’re staring down the barrel of something much more serious. Think less "economic slowdown" and more "historic upheaval."

“We’re at a decision-making point,” Dalio said bluntly. “And I’m worried about something worse than a recession if this isn’t handled well.” That “something” includes a stew of rising debt, deepening political rifts, global power struggles, and tariffs flying like shrapnel from Washington.

Sound familiar? It should. According to Dalio, it’s all eerily reminiscent of the 1930s—right before things went sideways for everyone.

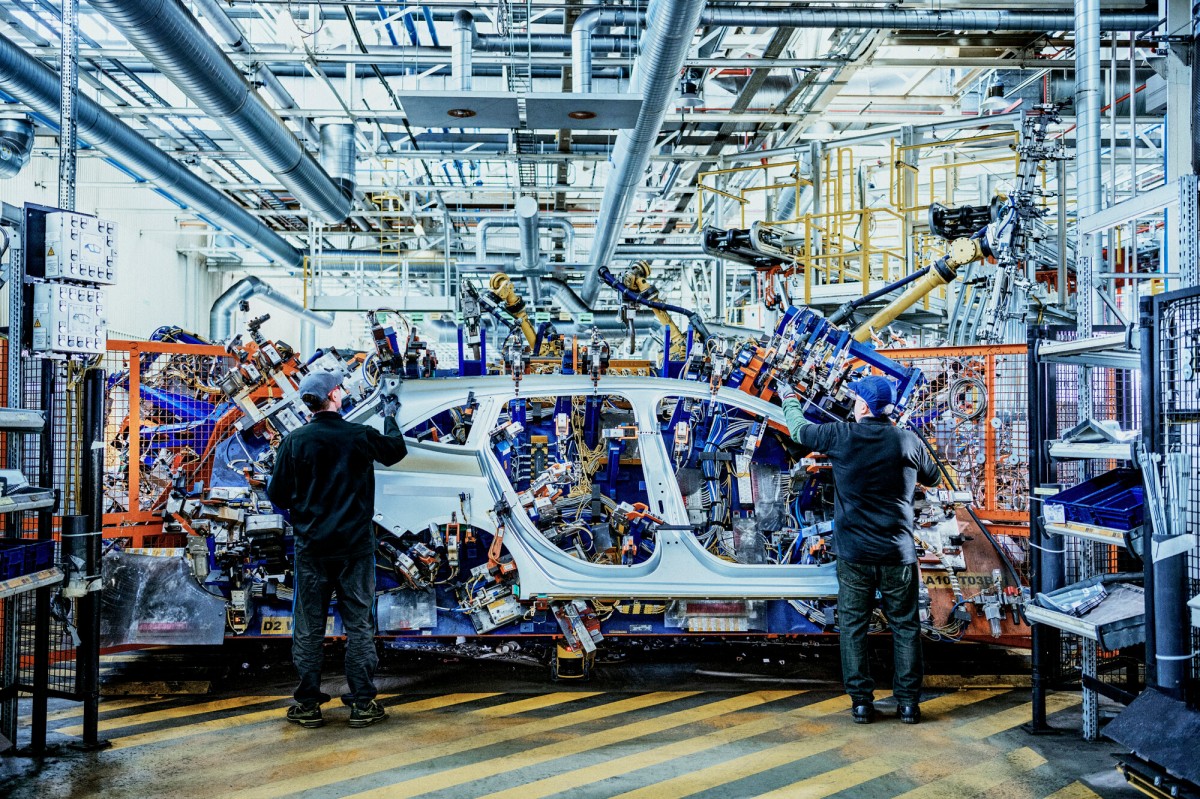

He’s especially critical of former President Donald Trump’s tariff-heavy approach to trade. Dalio doesn’t deny that tariffs can be useful—bringing back jobs, generating revenue—but he insists that how they're used makes all the difference. “It’s like throwing rocks into the gears of the production system,” he said, warning of “enormous” ripple effects on global supply chains and economic efficiency.

And the timing? Couldn’t be worse.

Goldman Sachs recently raised the probability of a U.S. recession within the next year to 45%. That was before Trump announced a minimum 10% tariff on all imports and slapped a whopping 145% duty on Chinese goods. China, of course, fired right back with a 125% levy of its own. It’s an economic tit-for-tat that threatens to spiral into something much more destructive.

But it’s not just about tariffs. Dalio is sounding the alarm about something much deeper—a fundamental shift in the global order. The U.S. is sitting on a mountain of debt. Political tensions at home are flaring like never before. And on the world stage, rising powers are challenging the status quo, with China and the U.S. clashing not just economically but ideologically.

“The last time we saw shifts like this—in debt, trade, power, and internal conflict—it didn’t end well,” Dalio warned. “It’s very disruptive. We’re messing with the foundations of the global system.”

In his view, the worst-case scenario includes the U.S. dollar losing its status as the world's go-to currency, internal unrest that spills outside the bounds of normal democratic process, and potentially even military conflict.

Sobering stuff. But then again, Dalio doesn’t tend to speak in hyperbole. If he’s this concerned, it’s worth paying attention.

Whether this moment becomes a turning point—or a tipping point—will depend on leadership, diplomacy, and a fair bit of luck. One thing’s for sure: business as usual isn’t going to cut it.

Support My Journey

If you’ve enjoyed this article, please consider donating! I’m saving up to buy a used car to keep my travels (and stories) rolling. Every little bit helps — and is deeply appreciated. GoGetFunding