The recent events that have transpired in the banking industry have left the nation in a state of apprehension. Just six weeks ago, we bore witness to three banks that were taken over by the Federal Deposit Insurance Corporation (FDIC), leading to a brief moment of paralysis.

It was then that I foretold that the First Republic Bank might be next in line to meet the same fate. Today might be the day that the bank meets its downfall unless there's a last-minute miracle that can save it from imminent doom. If First Republic Bank fails, it will mark the second-largest bank failure in American history, a catastrophic event that we may not recover.

As per the latest update, First Republic Bank has indeed failed, with the FDIC seizing control of its deposits and selling it to JP Morgan. According to Zero Hedge, the US unveiled a hybrid solution, one where the FDIC would seize the insolvent First Republic, making it the second biggest bank failure in US history, and immediately sell the bulk of its assets and all of its deposits to JP Morgan. This was done after all other attempts at a private rescue effort had failed. The bidding process was "highly competitive," but only JP Morgan was willing to buy the bank's toxic interest-only mortgages. JP Morgan has assumed all of First Republic's $92 billion in deposits, insured and uninsured, including the $5 billion in deposits they gave to First Republic on March 16. They have also bought most of the bank's assets, including about $173 billion in loans and $30 billion in securities.

It's a scenario that only serves to make the rich richer, with the average depositor being left in a state of vulnerability and uncertainty. If you thought your money was safe in the bank, you might want to reconsider that notion and do it quickly, as we saw how the domino effect rapidly took down one bank after another last month. For those looking for a safer investment, I recommend investing in precious metals. You can learn more about it by visiting hozonefly.com.

First Republic Bank's problems seem to be stemming from the increasing interest rates. CNBC reports that the bank has been focusing on high-net-worth individuals and their businesses, offering mortgages at low-interest rates to those customers. These mortgages, along with other long-term assets on the bank's balance sheet, have fallen in market value since the Federal Reserve began hiking rates last year. This has made investors worried that the bank would have to book a considerable loss if forced to sell those assets to raise cash.

On Friday, stocks for First Republic Bank plummeted by 43%, bringing the year-to-date fall to 97%. Fortune reports that a group of 11 banks that deposited $30 billion into the First Republic in March have been reluctant to band together on making a joint investment. Although proposals calling for a consortium of stronger banks to buy assets from First Republic for more than their market value have surfaced, no agreement has been reached. Some stronger firms have been waiting for the government to offer aid or put the bank in receivership, which they view as cleaner and potentially ending with a sale of the bank or its pieces at attractive prices.

The FDIC has been scrambling for the past month to put together a rescue deal for the First Republic, seeking bids from banks like JP Morgan Chase & Co., PNC Financial Services Group Inc., Citizens Financial Group Inc., Bank of America Corp., and US Bancorp. However, the deadline for acceptable bids came and went yesterday with no resolution. Experts believe that the FDIC will seize control of First Republic's deposits today, putting the beleaguered institution into receivership, a resolution that the FDIC prefers to avoid due to the prospect it will inflict a multibillion-dollar hit to its own deposit insurance fund. The agency is already

It's difficult to overstate the potential impact of bank failures like the one at First Republic. Not only does it represent a significant loss for the bank's customers and investors, but it also sends ripples through the entire financial system.

The failure of a major bank can shake confidence in the banking system as a whole, making it harder for other banks to raise capital or attract deposits. This can lead to a credit crunch and a contraction in the overall supply of money, which in turn can lead to a recession or even a depression.

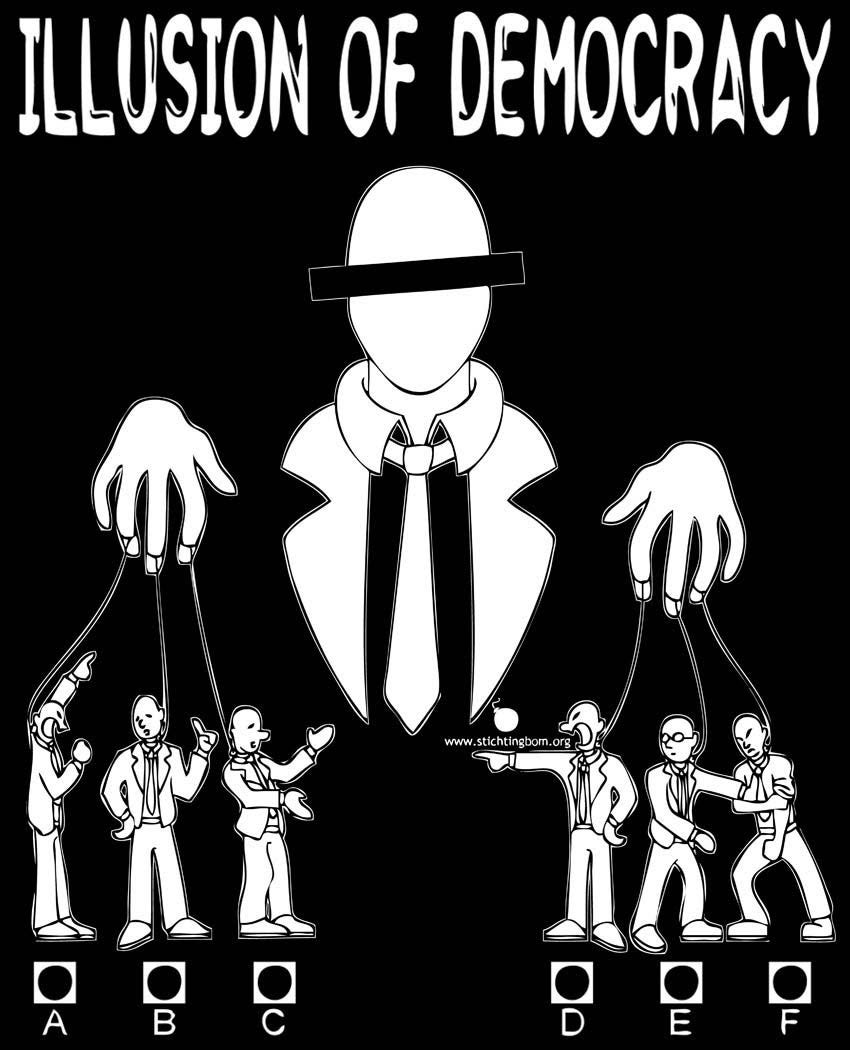

Moreover, the government's response to bank failures can have far-reaching consequences. In the case of First Republic, the FDIC stepped in to sell the bank's assets and deposits to JPMorgan, effectively socializing the losses and transferring them to taxpayers. This raises important questions about the role of government in the economy and the moral hazard created by too big-to-fail banks.

All of this underscores the importance of financial regulation and the need for a robust and resilient banking system. While it's impossible to eliminate all risk from the financial system, we can take steps to mitigate it and ensure that banks are held accountable for their actions. This requires not only strong regulations but also vigilant oversight and a willingness to take swift and decisive action when necessary.

So if you have money in the bank, it's worth considering how safe it really is. And if you're concerned about the health of the banking system, it's worth speaking up and demanding greater transparency and accountability from those in power.

Is this content hitting the mark for you? If so, consider supporting my work—buy me a virtual coffee! ☕ Your support keeps the ideas flowing. Thanks so much! 🙏 Please Contribute via GoGetFunding